The global arms industry experienced a significant surge in revenue last year, reaching a record $679 billion, driven largely by ongoing conflicts in Ukraine and Gaza, alongside heightened international tensions. However, this worldwide trend bypassed China’s major military contractors, whose revenues collectively fell by 10%. This downturn, detailed in a recent study by the Stockholm International Peace Research Institute (SIPRI), stands in stark contrast to robust growth figures reported by defense companies in other nations, including a 40% rise in Japan and a 36% increase in Germany, with U.S. firms seeing a 3.8% uptick.

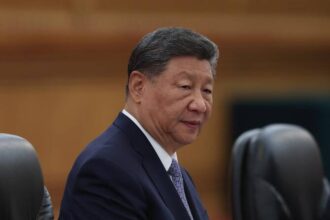

The decline in China’s military sector appears directly linked to an expansive anti-corruption campaign initiated by President Xi Jinping. This crackdown, which began in 2012, intensified within the People’s Liberation Army (PLA) in 2023, specifically targeting its Rocket Force. The purge led to the expulsion of eight high-ranking generals from the Communist Party on graft charges in October, including He Weidong, who held the second-highest position on the Central Military Commission, China’s paramount military command organization. Nan Tian, director of SIPRI’s Military Expenditure and Arms Production Program, highlighted that these corruption allegations led to the postponement or outright cancellation of significant arms contracts, introducing considerable uncertainty into the timeline and realization of China’s military modernization goals.

Despite three decades of consistent increases in its defense budget, reflecting Beijing’s growing strategic rivalry with the United States and simmering tensions over Taiwan and the South China Sea, the financial performance of its arms producers suffered. This period has seen China develop the world’s largest naval and coast guard fleets, including a new advanced aircraft carrier, alongside an impressive array of hypersonic missiles, nuclear weapons, and sophisticated air and sea drones. Yet, the recent SIPRI data indicates a pause in this momentum for its key defense firms.

Among the state-owned giants affected, AVIC, China’s largest arms manufacturer, Norinco, a producer of land systems, and CASC, specializing in aerospace and missiles, all reported revenue decreases. Norinco experienced the sharpest decline, with revenues falling by 31% to $14 billion. The SIPRI research points to corruption-related personnel changes at the leadership levels of Norinco and CASC as drivers of government reviews and project delays. Similarly, deliveries of military aircraft from AVIC reportedly slowed down. China’s Defense Ministry and the companies implicated have not yet responded to inquiries regarding these findings.

The implications of these disruptions extend beyond mere financial figures. Xiao Liang, a SIPRI researcher, suggested that the timeline for advanced systems crucial to the PLA’s Rocket Force – which manages China’s expanding arsenal of ballistic, hypersonic, and cruise missiles – could be jeopardized. This uncertainty also touches aerospace and cyber programs. Such delays could complicate the PLA’s stated objective of achieving key capabilities and readiness for warfighting by its 100th anniversary in 2027, a milestone for the force originally founded as Mao Zedong’s Red Army.

While the immediate impact of the corruption purge is evident in the revenue declines and project delays, Liang also offered a longer-term perspective. Despite these setbacks and the potential for increased costs and tighter procurement controls, he anticipates that China’s sustained investment in defense budgets and its political commitment to military modernization will continue. This suggests that while there may be some programmatic delays in the short to medium term, the overarching trajectory of China’s military expansion remains largely intact, albeit under a more scrutinized and controlled procurement environment.