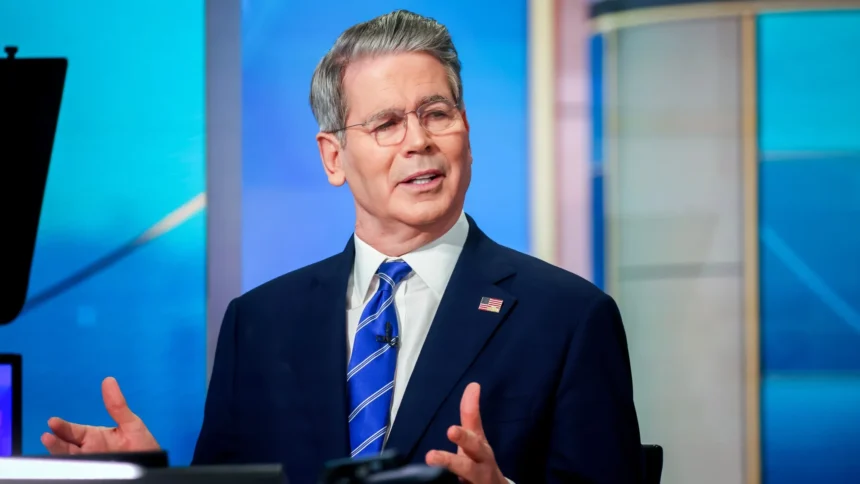

Noted investor and policy advisor Scott Bessent has weighed in on one of the most contentious debates in U.S. trade policy: tariffs on China. In recent remarks, Bessent suggested that the current tariff structure imposed on Chinese imports is “working pretty well” and does not require immediate changes, even as calls mount from various political and business circles for adjustments.

Tariffs: A Policy Tool That Endured

The United States has kept sweeping tariffs on Chinese goods since the Trump administration first imposed them in 2018, citing unfair trade practices, intellectual property theft, and a massive trade imbalance. While there were expectations that President Biden might roll back some of the measures, the tariffs have largely remained in place.

Bessent, who has advised policymakers and managed multi-billion-dollar investment portfolios, pointed out that the tariffs, while controversial, appear to have achieved several outcomes:

- Supply Chain Diversification: Many U.S. companies have begun reducing reliance on China by shifting production to Southeast Asia, Mexico, and even back to the U.S.

- Pressure on Beijing: The tariffs have constrained some of China’s export dominance, particularly in sectors such as steel, aluminum, and certain manufactured goods.

- Political Stability: Maintaining the tariffs has created a rare area of bipartisan consensus in Washington, with both Democrats and Republicans reluctant to appear “soft” on China.

A Measured Defense of the Status Quo

Rather than advocating for sweeping new trade barriers or a rollback, Bessent suggested that the current tariff regime represents a balanced approach.

“From a policy perspective, the tariffs are doing their job,” he noted. “They haven’t crippled the U.S. economy, they’ve encouraged diversification, and they’ve signaled to Beijing that the U.S. is serious about trade fairness.”

This pragmatic defense contrasts with louder voices on both sides of the debate. Some U.S. business groups argue the tariffs have driven up costs for American manufacturers and consumers, while others in Washington push for an even more aggressive stance against China.

U.S. Economic Impact: Contained but Noticeable

Economists remain split on the true costs of the tariffs. Some analyses show that U.S. companies and consumers have absorbed billions in added expenses, particularly in industries dependent on Chinese imports. However, Bessent and others note that the broader U.S. economy has adjusted.

- Inflation: Tariffs contributed modestly to price pressures, but other factors—such as energy costs and pandemic-related supply shocks—have been more significant drivers.

- Manufacturing Rebound: Some U.S. sectors, such as steel and aluminum, have seen a modest revival.

- Reshoring Trends: Tariffs have accelerated the conversation around reshoring and “friend-shoring,” aligning with strategic U.S. interests.

The China Side of the Equation

For China, the tariffs have been an irritant but not a crippling blow. Beijing has responded with its own counter-tariffs and subsidies to help Chinese exporters weather the pressure. Still, U.S. tariffs have contributed to broader challenges facing China’s economy, including slowing growth, weakening exports, and investor skepticism.

Bessent pointed out that the tariffs have forced China to reckon with reduced access to the U.S. market, nudging it to expand trade ties with other regions such as Southeast Asia, Africa, and the Middle East.

Politics Ahead of Policy

The durability of the tariffs is also a reflection of U.S. domestic politics. With the 2024 election cycle intensifying, no candidate—Republican or Democrat—wants to be seen as easing pressure on China. Bessent’s view that the status quo is “working pretty well” may resonate with policymakers who prefer to avoid risky moves in an election year.

- Republicans: Many push for tariffs to remain or even expand, framing China as America’s top strategic rival.

- Democrats: While some worry about costs to U.S. businesses, the political risks of cutting tariffs are high.

- Voters: Polls suggest a majority of Americans support a tough stance on China, reinforcing the bipartisan status quo.

Looking Ahead: Incremental Tweaks, Not Overhauls

While Bessent sees little need for dramatic change, minor adjustments could be on the horizon:

- Targeted Exemptions: Policymakers may allow certain industries exemptions to ease supply chain bottlenecks.

- Strategic Realignment: Tariffs could be adjusted to focus more on advanced technology and critical minerals, aligning with national security priorities.

- Coordination with Allies: The U.S. may seek to synchronize its trade pressure with Europe and Asia to create a broader front against unfair Chinese practices.

Conclusion: A Rare Case of Policy Stability

In an era of rapid shifts in global trade and volatile economic policymaking, the relative stability of U.S.-China tariffs stands out. Scott Bessent’s assertion that the status quo is “working pretty well” underscores a reality many in Washington quietly recognize: the tariffs may not be perfect, but they are serving their intended purpose without destabilizing the U.S. economy.

For now, it seems the U.S. will continue to live with its China tariff regime—part deterrent, part negotiation tool, and part symbol of America’s resolve in a new era of great-power competition.