As global conflicts intensify—especially between Israel and Iran—oil markets are responding with extreme volatility. Fear of supply disruptions, strategic chokepoint blockades, and broader geopolitical instability are fueling sudden price movements, with implications for consumers, governments, and investors worldwide.

Recent Price Movements

Oil has surged approximately 7–11% following Israeli strikes on Iranian targets, with Brent crude approaching $74 per barrel. Some analysts warn prices could climb to $120 if tensions escalate, particularly around the Strait of Hormuz. Still, global oversupply, rising production from outside OPEC+, and inconsistent demand continue to temper the rally. Prices could remain in the $70–80 range if the conflict stays localized.

Why the Market Is on Edge

- Geopolitical Risk Premium: Oil becomes a hedge during uncertainty. Investors flee to energy assets when political risks grow, raising prices sharply.

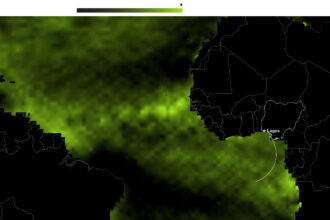

- Strait of Hormuz Threat: This chokepoint handles nearly 20% of the world’s oil supply. Any military blockade or disruption could trigger a sudden and extreme price spike, possibly surpassing $150 per barrel in severe scenarios.

- Global Production Landscape: While OPEC+ limits supply, the U.S., Brazil, and Canada are increasing output. Forecasts show production may exceed demand through early 2026, helping contain prices despite ongoing threats.

Impacts on Consumers and Markets

- Gas and Fuel Costs: Higher oil prices translate to increased costs for gasoline and heating fuel. In countries dependent on imports, this could strain household budgets and reduce spending.

- Inflation Risk: Energy price hikes could reignite inflation, forcing central banks to delay rate cuts and continue tight monetary policy longer than expected.

- Sectoral Winners and Losers: Energy and oil service companies are benefiting from price increases, while airlines and transport-heavy industries face higher operational costs.

Year-End Scenarios

- Baseline: Brent stabilizes near $80–90 per barrel, with conflict contained and production balancing out supply concerns.

- High-Risk: A full-scale regional war or disruption of the Strait of Hormuz could drive prices above $120.

- De-Escalation: Diplomatic progress or easing tensions, combined with high global production, could return prices to the $65–70 range.

Final Thought

Oil prices have jumped due to growing instability in the Middle East, but fundamentals like oversupply and alternative production sources are acting as stabilizers. Unless the conflict escalates into a broader regional war, prices may fluctuate but remain manageable. Strategic monitoring of military developments, global production trends, and policy shifts will be crucial in predicting what comes next for oil and the global economy.